The Importance of a Home Inspection

Buying a home is one of the biggest investments you'll ever make. It's a major decision that requires careful consideration and thorough evaluation. One critical step in this process is the home inspection. Whether you're a buyer or a seller, a home inspection holds immense importance and can greatl

Read More

Short-Term Rentals Poised for Post-Pandemic Comeba

As the world gradually recovers from the global pandemic, the real estate industry is experiencing a significant shift. One particular sector that is poised for a remarkable comeback is short-term rentals. These unique accommodations, once heavily impacted by travel restrictions and lockdowns, are n

Read More

Ways Real Estate Pros Can Keep More of Their Money

One of the most important aspects of being a successful real estate professional is managing your finances effectively. Whether you're a seasoned investor or just starting out in the industry, finding ways to keep more of your hard-earned money is always a top priority. In this blog post, we'll expl

Read More

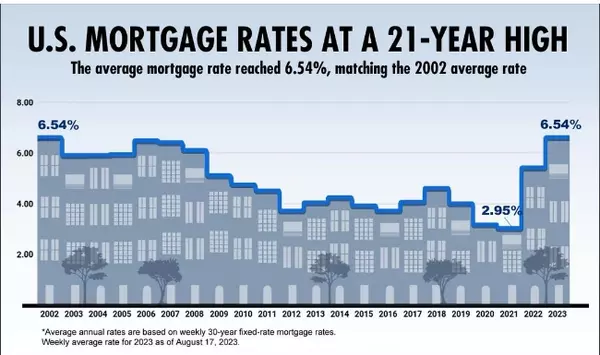

Will 2024 Be a Better Year for Homebuyers?

As we enter 2024, many prospective homebuyers are eagerly looking forward to what the future holds for the real estate market. With months of cooling inflation and positive economic indicators, the question arises: Will 2024 be a better year for homebuyers? According to recent real estate news, ther

Read More

Categories

Recent Posts